In recent years, the issue of withholding tax (WHT) has gained particular significance for businesses operating in Poland. Polish tax authorities are paying increasing attention not only to traditional royalty payments or interest, but also to payments associated with modern technological solutions. In particular, services delivered through cloud-based models – from access to data storage to the use of SaaS (Software-as-a-Service) applications – have come under the scrutiny of the Polish tax administration.

It is precisely in relation to such solutions that tax authorities in Poland have started to adopt a more stringent approach. In their view, payments for access to cloud services are not merely neutral charges for software usage, but may be classified as remuneration for the use of industrial equipment, and consequently – be subject to WHT under Polish tax law.

WHT and new technologies – how is the practice evolving in Poland?

Withholding tax in Poland is conventionally associated with licence fees, interest payments or remuneration for the use of industrial equipment. Initially, the doubts related to payments for servers, hosting or the use of software under end-user licences.

Polish administrative courts had previously ruled that the use of cloud services could not be equated with “use of industrial equipment” – particularly because Polish entities do not have physical access to the servers of foreign providers, and the subject of the agreement is rather the outcome in the form of a service (e.g. data storage or application functionality) rather than a right to the equipment itself.

However, in recent years, the Polish tax authorities have clearly broadened the interpretation of the term “industrial equipment.” In their view, IT infrastructure (servers, routers, switches) qualifies as such equipment – used in business operations and related to professional commerce.

Current practice of tax authorities in Poland

On 20 May 2025, the Director of the National Tax Information (KIS) in Poland issued an individual tax ruling (ref. 0111-KDIB1-1.4010.139.2025.2.MF), regarding payments for the use of software delivered under the SaaS (Software-as-a-Service) model. The applicant argued that since they do not acquire copyrights, but merely gain access to an online application for internal purposes, subscription fees should not be subject to withholding tax in Poland.

However, the Director of KIS did not agree with this position. He concluded that:

- remuneration for using cloud-based software constitutes payment for the use of “industrial equipment” under Polish tax law,

- such payments fall within the scope of Article 21(1)(1) of the Polish Corporate Income Tax Act,

- the Polish company, as the tax remitter, is obliged to withhold flat-rate WHT.

This means that the Polish tax authorities increasingly treat IT infrastructure made available via cloud models (servers, systems, applications) as industrial equipment – even if the Polish entity accesses them only remotely and in a limited capacity.

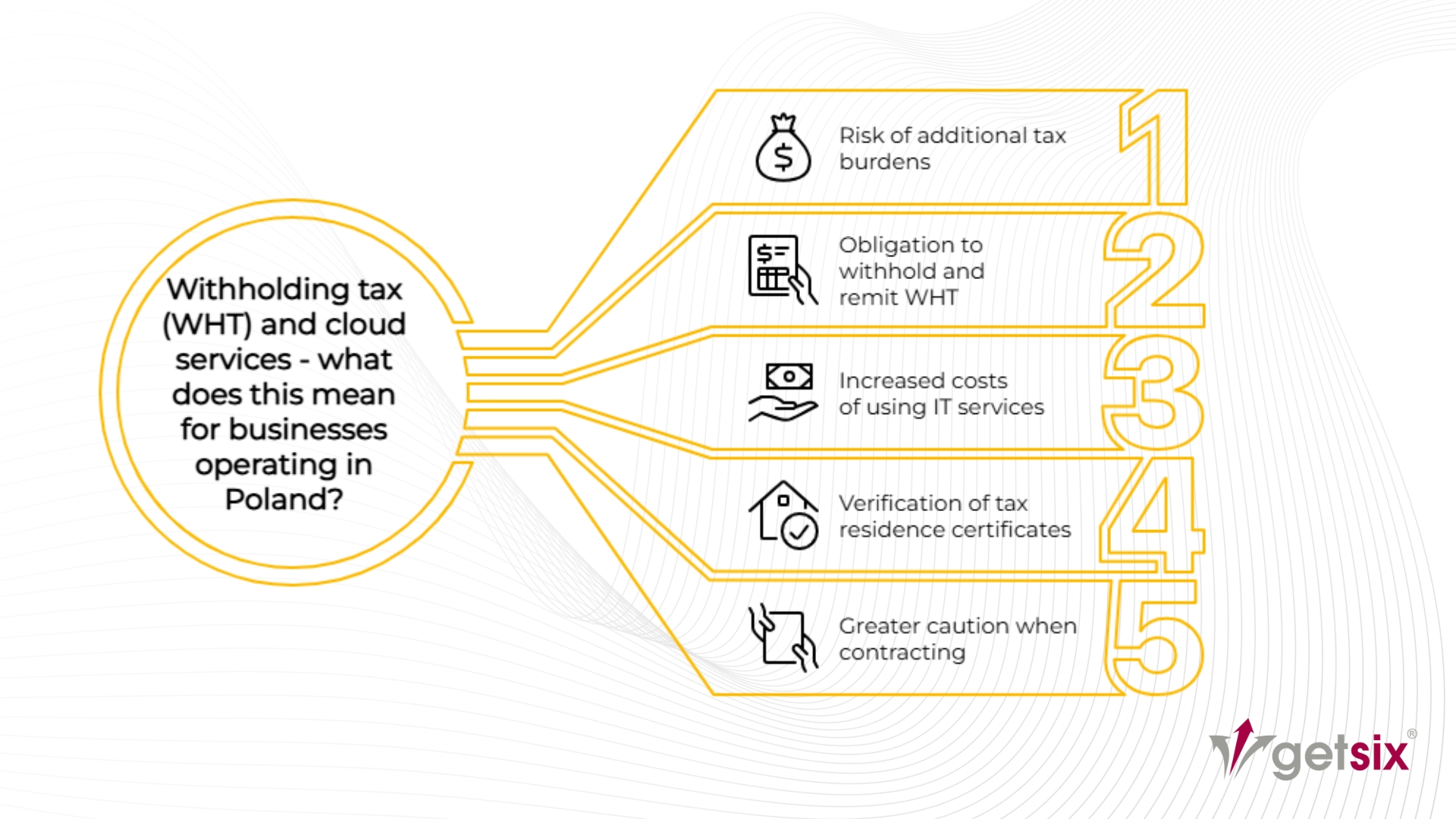

What does this mean for businesses operating in Poland?

For companies operating in Poland and using cloud services, this interpretation presents a significant risk of additional tax burdens. If subscription fees for SaaS access are considered remuneration for the use of industrial equipment, the Polish business becomes responsible for withholding and remitting WHT. This may increase the costs of using IT services and necessitate verification of foreign counterparties’ certificates of tax residence or a review of the applicability of double tax treaties signed by Poland.

In practice, even standard online software subscriptions – which many Polish taxpayers previously regarded as tax-neutral – may now be challenged by the tax authorities. Businesses must therefore implement additional verification procedures and exercise greater caution when contracting with foreign cloud service providers.

The May 2025 tax ruling confirms that Polish tax authorities apply an increasingly broad interpretation of the term “industrial equipment,” extending it to cover IT infrastructure used in cloud-based service models. In practice, this means that payments for online software access – although seemingly intangible services – may be treated as payments subject to withholding tax in Poland.

For businesses using SaaS or other cloud-based solutions in Poland, this calls for increased vigilance. Each transaction should be assessed individually, taking into account:

- the terms of the agreement with the foreign provider,

- the provisions of the relevant double tax treaty concluded by Poland,

- the obligation to verify and document the contractor’s tax residency (certificate of residence),

- the formalities set out in Article 26 of the Polish Corporate Income Tax Act.

Improper classification of payments may result in serious consequences – from tax arrears to disputes with the Polish tax authorities. Although in some cases it may be possible to apply an exemption under a double tax agreement (DTA), the procedure itself involves additional obligations and requires thorough documentation.

If your company operates in Poland and uses cloud services or makes payments for SaaS software to foreign providers, it is worth consulting with experts. The getsix® team will help you assess the risks and prepare for any obligations related to WHT in Poland. Contact us using the form.